south dakota sales tax rates by county

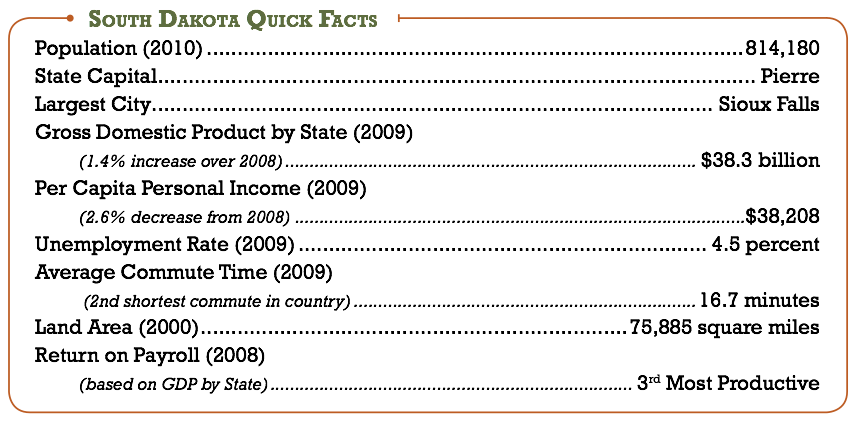

South Dakota has a higher state sales tax. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Click here for a larger sales tax map or here for a sales tax table. Combined with the state sales tax the highest sales tax rate in Arkansas is 12625 in the city.

Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55There are a total of 397 local tax jurisdictions across the state collecting an average local tax of 2636.

New Municipal Tax Changes Effective July 1 2021 South Dakota Department Of Revenue

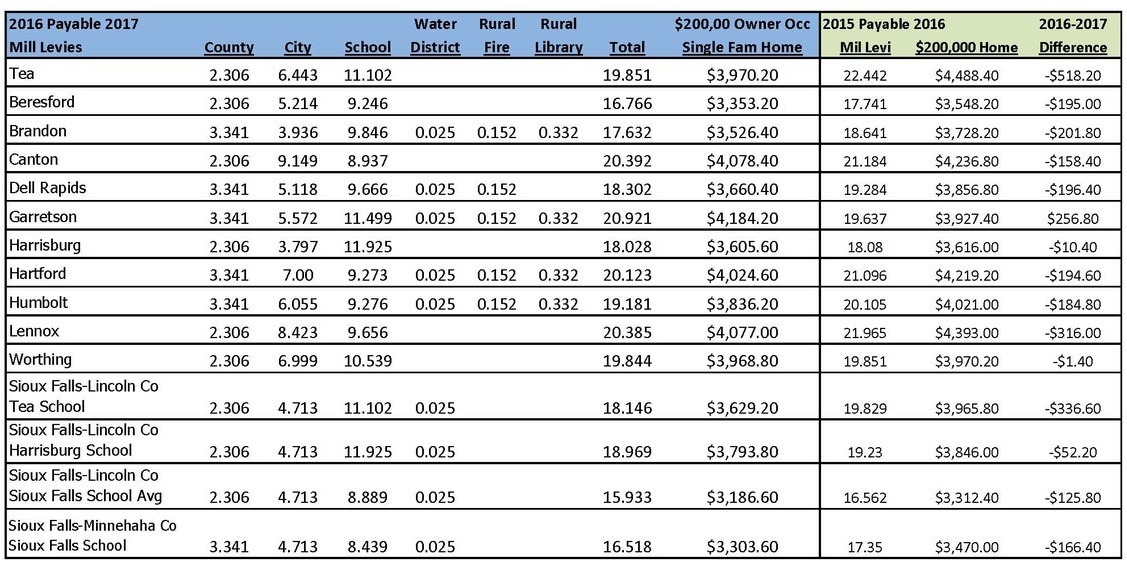

Tax Information In Tea South Dakota City Of Tea

South Dakota Income Tax Calculator Smartasset

South Dakota Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

North Dakota Sales Tax Rates By City County 2022

Meet The District 9 Republicans Candidates Vying For Sd House Senate

South Dakota Sales Tax Rates By City County 2022

What Is Food Insecurity Feeding South Dakota

Businesses South Dakota Department Of Revenue

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

The Most And Least Tax Friendly Us States

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)